From The World Bank Group

Migration and Remittance Flows: Recent Trends and Outlook, 2013-2016

Remittance flows to developing countries are expected to reach $414 billion in 2013

(up 6.3 percent over 2012), and $540 billion by 2016. Worldwide, remittance flows

may reach $550 billion in 2013 and over $700 billion by 2016. These increases are

projected in spite of a $10 billion downward revision in the data due to the

introduction of the Sixth Edition of the IMF Balance of Payments Manual and the

reclassification of several developing countries as high-income countries.

As the development community debates the post-2015 development agenda, there

is a case to be made for reducing migration costs, including the costs of recruitment,

visa, passport, and residency permits.

|

From Finance & Development, September 2013, Vol. 50, No. 3

Beyond the Household

Remittances that migrants send home to their families also have a major impact on the overall economy

Ralph Chami and Connel Fullenkamp

Remittances—private income

transfers from migrants to family

members in their home country—

are good news for the families that

receive them. Often sent a few hundred dollars

at a time, the remittances increase disposable

income and are generally spent on

consumption—of food, clothing, medicine,

shelter, and electronic equipment. They have

been growing for decades (see Chart 1). Remittances

help lift huge numbers of people

out of poverty by enabling them to consume

more than they could otherwise (Abdih, Barajas,

and others, 2012). They also tend to help

the recipients maintain a higher level of consumption

during economic adversity (Chami,

Hakura, and Montiel, 2012). Recent studies report

that these flows allow households to work

less, take on risky projects they would avoid if

they did not receive this additional source of

income, or invest in the education and health

care of the household. In other words, remittances

are a boon for households.But...

|

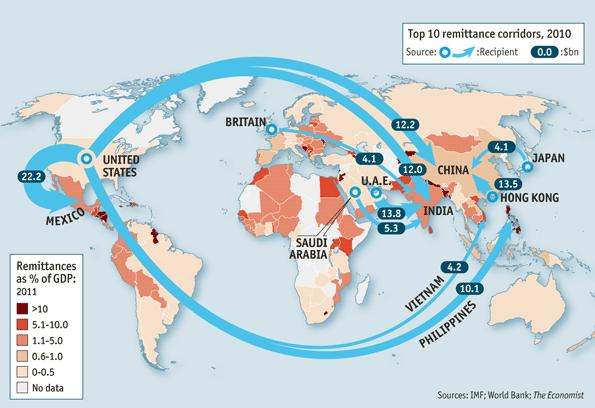

From The Economist - 28th April 2012

Remittance corridors

New Rivers of Gold

Remittances from unlikely places are helping poor countries in the

downturn

April 23, 2012—Officially

recorded remittance flows to developing countries are estimated to have

reached $372 billion in 2011, an increase of 12.1 percent over 2010.

Remittances

Data:

Inflows,

Outflows

March

30, 2011—With 30 mn Africans outside their countries, migration is

a vital lifeline for the continent. Press

release | Blog

| Webpage | Data | Podcast | Video

..

|

From The World Bank Group

Migration and Remittances Factbook 2011

Officially recorded remittance flows to developing countries are

estimated to increase by 6 percent to $325 billion in 2010. This marks

a healthy recovery from a 5.5 percent decline registered in 2009.

Remittance flows are expected to increase by 6.2 percent in 2011 and

8.1 percent in 2012, to reach $374 billion by 2012.

|

From The World Bank Group

Migration and Remittances Factbook 2008

This factbook provides a snapshot of migration and remittances for all

countries, regions and income groups of the world, compiled from

available data from various sources.

|

Global Economic Prospects 2006

Economic Implications of Remittances and Migration

WASHINGTON, November 16, 2005 — International migration can generate

substantial welfare gains for migrants and their families, as well as

their origin and destination countries, if policies to better manage

the flow of migrants and facilitate the transfer of remittances are

pursued, says the World Bank's annual Global Economic Prospects (GEP)

report for 2006.

“With the number of migrants worldwide now reaching almost 200 million,

their productivity and earnings are a powerful force for poverty

reduction,” said François Bourguignon, World Bank Chief Economist and

Senior Vice President for Development Economics.

“Remittances, in particular, are an important way out of extreme

poverty for a large number of people. The challenge facing policymakers

is to fully achieve the potential economic benefits of migration, while

managing the associated social and political implications.”

|

|

DP2003/64

Riccardo Faini:

Is the Brain

Drain an Unmitigated Blessing?

(PDF 200KB)

Increasingly, immigration policies tend to favour the entry of skilled

workers, raising

substantial concerns among sending countries. The ‘revisionist’

approach to the analysis

of the brain drain holds that such concerns are largely unwarranted.

First, sustained

migratory flows may be associated with an equally large flow of

remittances. Second,

migrants may return home after having acquired a set of productive

skills. Finally, the

ability to migrate abroad may boost the incentive to acquire skills by

home residents.

This paper takes a further look at the link between skilled migration,

education, and

remittances. It finds little support for the revisionist approach.

First, a higher skilled

content of migration is found to be associated with a lower flow of

remittances. Second,

there is little evidence suggesting that raising the skill composition

of migration has a

positive effect on the educational achievements in the home country.

Andrés

Solimano - 2003>

Remittances by

Emigrants: Issues and Evidence

(PDF 231KB)

Remittances, after foreign direct investment, are currently the most

important source of

external finance to developing countries. Remittances surpass foreign

aid, and tend to be

more stable than such volatile capital flows as portfolio investment

and international

bank credit. Remittances are also an international redistribution from

low-income

migrants to their families in the home country.

Worldwide, remittances are relatively concentrated in a group of

developing countries:

the top 20 recipient-countries of workers’ remittances capture around

80 per cent of

total remittances by workers to the developing countries. The three

main source

countries of remittances are the US, Saudi Arabia and Germany, while in

terms of

value, the three main recipient countries are India, Mexico and the

Philippines.

.../.

|

From The World Bank Group

International Migration, Remittances and

the Brain Drain

International

Migration Reduces Poverty in Developing Countries, But Results in

Massive Brain Drain for Some.-

October 24, 2005, Washington, D.C—Migrants' remittances reduce poverty

in developing countries, but massive emigration of highly-skilled

citizens poses troubling dilemmas for many smaller low-income

countries, a new World Bank research study finds. International

Migration, Remittances and the Brain Drain, a study produced by the

Bank's research department, includes a detailed analysis of household

survey data in Mexico, Guatemala and the Philippines---all countries

that produce millions of migrants---which concludes that families whose

members include migrants living abroad have higher incomes than those

with no migrants.

------------------ |

R. H. Adams (2003):

International migration,

remittances, and the brain drain; a study of 24 labour exporting

countries

While the level of

international migration and remittances continues to grow, data on

international migration remains unreliable. At the international level,

there is no consistent set of statistics on the number or skill

characteristics of international migrants. At the national level, most

labor-exporting countries do not collect data on their migrants. Adams

tries to overcome these problems by constructing a new data set of 24

large, labor-exporting countries and using estimates of migration and

educational attainment based on United States and OECD records. He uses

these new data to address the key policy question: How pervasive is the

brain drain from labor-exporting countries? Three basic findings

emerge: With respect to legal migration, international migration

involves the movement of the educated. The vast majority of migrants to

both the United States and the OECD have a secondary (high school)

education or higher. While migrants are well-educated, international

migration does not tend to take a very high proportion of the best

educated. For 22 of the 33 countries in which educational attainment

data can be estimated, less than 10 percent of the best educated

(tertiary-educated) population of labor-exporting countries has

migrated. For a handful of labor-exporting countries, international

migration does cause brain drain. For example, for the five Latin

American countries (Dominican Republic, El Salvador, Guatemala, Jamaica

and Mexico) located closest to the United States, migration takes a

large share of the best educated. This finding suggests that more work

needs to be done on the relationship between brain drain, geographical

proximity to labor-receiving countries, and the size of the (educated)

population of labor-exporting countries. |

From "State of the World Population", UNFPA,

2004:

Migration and

Urbanization

- chapter 4

|

Migration Police Institute

The Global Remittances Guide

presents remittance trends over time worldwide, in six regions, and in

the top remittances-receiving countries in terms of volume and share of

GDP.

More

resources on the Hub

|

| |

From the Interamerican

Development Bank:

More than 90 papers on remittances

More than 40 reports on remittances

|

| |

ALERTNET (The Reuter Foundation)

Reuters AlertNet is a humanitarian news network

based around a popular website. It aims to keep relief professionals

and the wider public up-to-date on humanitarian crises around the

globe. AlertNet attracts upwards of ten million users a year, has a

network of 400 contributing humanitarian organizations and its weekly

email digest is received by more than 26,000 readers.

It was started in 1997 by Reuters Foundation - an educational and

humanitarian trust - to place Reuters' core skills of speed, accuracy

and freedom from bias at the service of the humanitarian community.

AlertNet has won a Popular Communication award for technological

innovation, a NetMedia European Online Journalism Award for its

coverage of natural disasters and has been named a Millennium Product

by the British Government -- an award for outstanding applications of

innovative technologies.

|

|

R.

Hinojosa Ojeda - UCLA - NAID Center - 2003

Transnational Migration,

Remittances and Development in North America:

Globalization Lessons from the OaxaCalifornia Transnational

Village/Community Modeling Project

While much attention has recently been given to the developmental

impacts of Globalization, defined primarily as the liberalized flows of

trade and investment, this report argues that the process of migration,

remittances and the formation of transnational communities, along with

associated policy responses, can have a much greater impact, both

positive and negative, on the prospects for sustainable development and

equity in both rich and developing countries. The principal findings of

this report are that transnational policy coordination in the North

American context, specifically focused on improved remittance

intermediation for investment in both migrant sending and receiving

areas, can have potentially dramatic effects on improving the living

conditions of transnational migrant families, as well as the

sustainable and equitable development of communities in both the U.S.

and Latin America.

P. De

Vasconcelos - 2005

Improving the

development

impact of remittances

United Nations Expert Group Meeting on International Migration and

Development

Population Division - Department of Economic and Social Affairs

United Nations Secretariat - New York

Call it the case of the missing billions. For decades, millions of

migrant

workers have been sending billions of dollars back to their home

countries to

support their families. Yet the impact of these huge international

flows of

both money and workers is only now beginning to be understood.

More than $45 billion flowed from the rest of the world to Latin

American and

the Caribbean (LAC) alone in 2004—exceeding the combined total of

foreign

direct investment and foreign aid once again for the entire region (see

map

1). And these figures undoubtedly underestimate the actual totals,

because

of problems in counting and tracking these flows—known as remittances.

A. H.

Hastings - 2006

Entry of MFIs into the

Remittance Market: Opportunities and Challenges

Prepared for The Global Microcredit Summit - Halifax, Nova Scotia,

Canada - November 13, 2006

In 2005, migrant worker remittances – the portion of migrants’ earnings

returned to their country of origin – totaled approximately US$232

billion

globally – three times official development aide of US$78.6 billion

dollars. In

fact, formal remittances constitute the second largest source of

external

funding for developing countries behind Foreign Direct Investment. The

$46

billion in remittances sent to Latin America and the Caribbean last

year by 30

million migrants was nearly equal to all foreign investment in private

companies! Moreover, migration and remittance experts argue that

unofficial

transfers could be almost as large as, if not larger than, the formal

flows.3

The importance of the flow of remittances for developing countries

cannot be

underestimated. Remittances account for more than 10 percent of the

gross

domestic products (GDP) of 15 developing countries studied by the

International Monetary Fund (IMF). This is true for some islands in the

Caribbean and Pacific and for several labor-exporting countries such as

Albania, El Salvador, Jordan, and the Philippines. Remittances account

for

over 29 percent of Nicaragua’s GDP.4 In Jamaica, remittances generate

more

revenues than foreign trade. In Haiti, in every year since 1996,

remittances

have been consistently greater than the total amount of revenue

generated...

M.

Orozco - 2004

Institute for the Study of International Migration

Georgetown University - Washington, DC

The Remittance Marketplace: Prices, Policy and

Financial Institutions

Over the past several months a growing number of countries, including

the United States,

have committed themselves to facilitating remittance transfers by

immigrants who send money

back to their home countries. Leaders of the major industrialized

democracies and Russia at the

annual summit of the Group of Eight (G8) countries that begins June 8,

2004 are expected to call

for efforts to reduce the costs of transfers and to promote a greater

role by banks and other

financial institutions in an industry currently dominated by wire

transfer firms. In January, leaders

of the Western Hemisphere meeting at the Special Summit of the Americas

in January called for

the costs of remittances to be cut in half by 2008.

To better understand the challenges involved in meeting these goals,

the Pew Hispanic

Center commissioned Manuel Orozco, a senior researcher at Georgetown

University’s Institute

for the Study of International Migration to conduct a detailed

assessment of the marketplace for

remittance transfer services between the United States and Latin

America. The study reached two

major conclusions relevant to the new initiatives:...

D.

Ratha and J. Riedberg - 2005

World Bank

On reducing remittance

costs

High fees charged by remittance service providers is a major challenge

for policy

makers interested in facilitating international migrant remittance

flows to developing

countries. This paper discusses some of the factors that influence the

price of remittance

services. Drawing on conversations with some remittance service

providers, this paper

argues that remittance services should be recognized as a self-standing

industry separate

from banking services. That would help efforts to simplify and

harmonize regulations

relating to remittances, thereby encouraging competition in the

remittance market.

Improving access of smaller remittance service providers such as credit

unions and larger

microfinance institutions clearing and settlement systems would also

help improve

competition and reduce remittance costs. Finally, improving the access

of undocumented

migrants to formal remittance channels, especially banks, would have a

significant impact

on remittance costs and also on discouraging the use of informal

channels.

M.

Orozco - 2002

Attracting

remittances:

Market, money and reduced costs

Report commissioned by the Multilateral Investment Fund of the

Inter-American Development Bank, Washington, DC.

This report analyses the market of remittances from the United States

to nine Central

American and Caribbean countries from the perspective of their business

practices. The

report focuses on remittance companies, business practices that benefit

their customers

sending and receiving remittances by criteria such as lower charges,

convenient business

locations, and community outreach. Money transfer charges as well as

exchange rate

differentials continue to be of concern for nine major Latin American

remittance recipient

countries. A key finding is that remittances are less costly when

competition is greater.

As the report shows, charges in fees and exchange rate incurred to send

and receive

remittances can add up to 14 percent of the amount sent. It is in the

interest of nations

and families receiving remittances to increase the quantity and flow of

remittance

monies, in part by reducing the share lost to transaction costs, and in

part by increasing

the gross flow of migrant remittances and investments.

F.

Lozano-Ascencio

Universidad Nacional Autónoma de México

Remittance behaviour

among Latin American immigrants

in the United States

This paper analyzes the factors that influence remittance behavior in

the United

States of Latin American immigrants. Data for this study come from The

National Survey of Latinos, conducted in 2002, and is analyzed using

logistic

regressions. Individual characteristics, financial ability to remit,

and family

obligations in the home and in the host country are hypothesized to

affect

remittance behavior. Results of the regression analyses confirm

previous

research findings, with the exception of one: those migrants who have a

bank

account in the host country are more likely to transfer remittances

than

migrants who do not have one. Therefore, having a bank account in the

country

of destination –regardless of their migratory status– has allowed

migrants to

better administer their economic resources, has increased their

likeliness of

sending remittances to their countries of origin, and has helped them

with their

process to consolidate their economic citizenship.

Bendixen

and Associates - 2008

Repor Commissioned by the Inter_American Development Bank and MIF

Latin American

Immigrants

in the United States:

Migration Dynamics and Patterns

M.

Orozco - 2004

Remittances to Latin

America and the Caribbean:

Issues and perspectives on development

Report Commissioned by the Organization of American States

When most people think of the flow of foreign currency to Latin America

and the Caribbean

(LAC), they probably assume that foreign aid or investment by business

accounts for most of the

money arriving in Latin countries. In fact, immigrant remittances –

money sent by Latin

Americans living and working in other countries, most notably the U.S.,

to their families in their

countries of origin – is the largest source of foreign capital flowing

to LAC today. In 2003, Latin

America received $38 billion.1 The significance of this financial

resource is therefore hard to

understate. Moreover, the volume and contribution of remittances raises

crucial questions

regarding the details of the actual contribution to growth, and how the

remittance transfers can be

maximized through a range of policy options, ranging from lower sending

costs to enhancing

equity and employment generation.

This endeavor to better understand the nature of migrant remittances

and to maximize their

financial benefits is the focus of this paper. It is also a key concern

of the Organization of the

American States (OAS). Indeed, during the 2004 OAS’s Summit of the

Americas, the presidents

of the hemisphere declared the need to reduce transaction costs by 50

percent in the next five

years. By reducing the cost of transmitting money, more money is freed

up for LAC families and

communities, thus enhancing the developmental potential of remittances.

When thinking about the relationship between development and

remittances, it is important to

keep four premises in mind:

First, these financial flows represent

a significance volume with

broad economic effects.

Second, while remittances primarily go

to the poor, remittances alone

are not a solution to the structural constraints of poverty. In many

and perhaps most cases,

remittances provide a temporary relief to families’ poverty, but seldom

provide a permanent

avenue into financial security.

Third, in order to strengthen ways in

which remittances can

promote sustainable development, concrete policies need to be adopted.

Fourth, any approach

to remittances demands a consideration of the agents involved,

particularly immigrants and their

families who are responsible for this flow.

The same report as a .doc file

Bendixen

and Associates - 2005

Repor Commissioned by the Inter_American Development Bank and MIF

Sending money to Latin

America: the human face of remittances

L.

Suki -2007

Columbia University

Competition and

Remittances in Latin

America: Lower Prices and More Efficient Markets

Along with accelerating migration from Latin America and the Caribbean

(LAC), the

growing flow of worker remittances – money sent home by migrants abroad

- has rapidly

gained the attention of governments, the private sector and civil

society as an important issue

in development. Remittances to Latin America and the Caribbean reached

nearly $54 billion

in 2005. Increasing competition in remittances markets has been

identified as a means of

lowering transaction costs and improving the efficiency of the market.

This theme also has

far-reaching development consequences in achieving national policy

objectives, especially in

the context of increasing financial access to the poor. While the study

of remittances and the

competition landscape of the industry is still in its infancy, this

paper attempts to highlight

gaps between ideal competitive market conditions and current

circumstances.

Although prices for remittances to LAC - often high and widely variable

- have fallen with

competition in many corridors, certain remittance service providers

(RSPs) exercise market

power, charging above market prices. While service options and quality

standards have

improved with new entrants, services and innovations, geographic

disparities persist within

and among countries depending on their financial infrastructure, as

well as other factors.

The economics of the remittances industry, especially its geographic

fragmentation and the

importance of building acquisition and distribution networks, generates

economic challenges

for new entrants and incumbents. Structural and systemic constraints to

more competitive

conditions - lack of transparency, underdeveloped financial

infrastructure, challenging legal

and regulatory frameworks and poor financial access – may set up

barriers to entry that

maintain incumbent institutions’ large proportion of LAC remittances

markets.

Regional

Seminar “Migrants’ remittances: An alternative for Latin America and

the Caribbean?”

Caracas, Venezuela -

26 and 27 July 2004

SP/SRRM-UAALC/Di Nº 3/Rev. 1

SELA/CAF

Current trends in

migrants’ remittances

in Latin America and the Caribbean:

An evaluation of their social

and economic importance

This document is aimed at examining the recent trends in remittances to

the Latin American and Caribbean region; evaluating the economic and

social importance of these resources for development in migrants’

countries of origin; analysing the socio-demographic characteristics of

the population transferring remittances and the obstacles to the

functioning of remittance transfer systems; and assessing their

economic and productive potential for development in migrants’

countries of origin.

During the period 1995-2002, money remittances to Latin America and the

Caribbean (LAC) had an extraordinary growth, as they rose from US$ 11.7

billion to US$ 24.4 billion. These figures confirm that LAC was the

region with the most dynamic growth in the world in terms of reception

of remittances, since the remittances it received accounted for 23.2%

of the global total in 1995, and in 2002 that share rose to 32.2%.

Within the region, it can be clearly seen that the largest flow of

remittances goes into Mexico: From US$ 3.7 billion in 1995 – which

accounted for 31% of total remittances sent to the region – transfers

to Mexico rose to nearly US$ 10 billion in 2002, representing 40% of

regional remittances. In 2003, remittances to Mexico surpassed US$ 13

billion, and estimates indicate that they will continue to rise to over

US$ 15 billion in 2004.

As far as remittances’ share in the Gross Domestic Product (GDP) is

concerned, it can be seen that while remittances into LAC represented

0.7% of the region’s GDP in 1995, that figure grew to 1.4% in 2002.

However, in the case of some Central American countries such as El

Salvador, Honduras and Nicaragua, as well as in Dominican Republic and

Jamaica, in the Caribbean, remittances’ share in the GDP was actually

higher than 10%. Therefore, the impact of remittances tends to be

stronger in smaller countries, which allegedly are also poorer and have

a less diversified productive structure.

Sergio

Bendixen, President, Bendixen and Associates

Testimony to the House

Financial Services Subcommittee on

Domestic and International Monetary Policy, Trade, and Technology

"The Role of Remittances in Leveraging Sustainable Development

in Latin America and the Caribbean"

March 7, 2007

A great deal has happened in the remittance market in recent years.

Efforts to improve remittance data collection, increase competition and

reduce cost in the remittance industry, and explore the development

impact of remittances have born fruit. Today, we know that:

• Remittances sent to Latin America and the Caribbean were more than

$62.3 billion in 2006, surpassing the combined amount of net official

development assistance and foreign direct investment to the region;

• Money transfer costs have been reduced by over 50 percent;

• Remittances constitute one of the broadest and most effective poverty

alleviation programs in the world. In Latin America and the Caribbean,

an estimated 8-10

million families would fall below the poverty line without remittance

income. For them, remittances are critically needed.

The challenge now is to help leverage the economic development impact

of remittances. For this reason, the 2006 survey of the United States

had a particular focus on the banking practices of immigrants,

remittance investment potential, and the financial products that

senders and receivers are most interested in receiving.

Bendixen

and Associates

Multilateral Investment Fund

Inter-American Development Bank

Survey of Remittance

Senders: U.S. to Latin America

Nov / Dec 2001 - 1,000 Interviews - Margin of Error: 3%

Multilateral Investment Fund - Inter-American Development

Bank

Remittances to Latin

America and the

Caribbean

February 2002

Remittances -- the portion of international migrant workers’ earnings

sent back to countries of origin – provide a distinctly human dimension

to globalization. For generations, financial flows back to the “home

country” have constituted an important means of support to family

members remaining in less developed countries.

However, as the scale of migration has increased in recent years,

leading to a dramatic acceleration in remittances, their social and

economic impact has grown well beyond family relationships, and is now

drawing national and international attention. Improvements in

transportation, communication and information technologies make it much

easier for migrant workers and their families, not only to maintain

close personal contact, but also to create significant new

opportunities for economic exchange across national borders.

Nowhere is this more apparent than in Latin America and the Caribbean

(LAC) where remittances currently constitute a critical flow of foreign

currency to the majority of countries. The implications for national

economies—and the corresponding potential multiplier effect on GDP,

consumption and investment—are becoming major financial and development

policy issues for recipient countries throughout the region.

Latin

America & the Caribbean: Remittances by Selected Countries

- 1999 (US$ millions)

Statistical overview for

“Remittances

as a Development Tool: A Regional Conference,”

The following statistical overview is provided as background to the

conference “Remittances

as a Development Tool: A Regional Conference,” sponsored by the

Multilateral Investment

Fund (MIF) of the Inter-American Development Bank (IDB), and the

Inter-American

Dialogue, on May 17-18, 2001, at IDB Headquarters in Washington, D.C.

This conference will

address three key themes: the economic role of remittances, reducing

the cost of transfers, and

channeling migrant capital more toward investment opportunities.

Latin American and the

Caribbean Foreign-Born Population 14.47 million

U.S. Census

2000

Methodology

The data in this overview have been drawn from calculations provided by

central banks of

remittance-receiving countries through 1999, and publications of the

World Bank, International

Monetary Fund, and United Nations. However, as many remittances flow

through private

|

From the World Bank - Public

Disclosure Authorized WPS3957

R. Aggarwal, A. Demirguc-Kunt, M. S. Martinez Peria - 2006

Do workers' remittances promote financial development ?

Workers' remittances to

developing countries have become the second largest type of flows after

foreign direct investment. The authors use data on workers' remittance

flows to 99 developing countries from 1975-2003 to study the impact of

remittances on financial sector development. In particular, they

examine whether remittances contribute to increasing the aggregate

level of deposits and credit intermediated by the local banking sector.

This is an important question considering the extensive literature that

has documented the growth-enhancing and poverty-reducing effects of

financial development. The findings provide strong support for the

notion that remittances promote financial development in developing

countries.

|

Final

Report on the Ministerial Conference of the Least-Developed Countries

on Enhancing the Development impact of Remittances

February

2006

International Organization for Migration (IOM)

In response to the growing importance of remittances and their

development potential for LDCs, IOM, in collaboration with the

Government of Benin and the United Nations Office of the High

Representative for the Least Developed Countries, Landlocked Developing

Countries and Small Island Developing States (UN-OHRLLS) organized a

two-day ministerial conference on remittances to LDCs entitled

"Ministerial Conference of the Least Developed Countries on Enhancing

the Development Impact of Remittances".

The overall objective of the conference was to explore avenues to

enhance and improve the development impact of remittances in LDCs. The

conference provided a platform for participants to share experiences

and lessons learned, consult on issues faced by migrant remitters and

propose practical solutions to optimize the development benefits of

remittances.

|

|

Inter-American

Development Bank - 2006

Sustaining Development

for all

Expanding Access to Economic Activity and Social Services

Access to financial services (credit, savings

or micro-insurance) for the poor has proven to be essential for

productive investments—including the

increasing flow of remittances—that help them escape poverty and

provides them with a low cost risk

management tool to cope with negative economic shocks. While there have

been significant advances

in increasing access to financial services to low-income populations,

aggregate figures show that there

is still a long way to go.

Asian

Development Bank - 2003

By Kevin Mellyn

Workers remittances as a

development tool opportunity for the Philippines

1. Remittances by individuals working abroad to their home country is a

very old phenomenon. After the Great Famine of 1846–1848, an Irish

Diaspora spread across the British Empire and the Americas.

Remittances, especially from female domestics in the US, became the

single most important source of capital for the Irish countryside.

Remittances from the US to Italy were of vital importance when foreign

credit was cut off in 1907. From 1950–1960, remittances were the key to

the development of Greece, Portugal, Spain, and Yugoslavia.

2. The modern appreciation of remittances as a development tool is very

recent and represents an irony of globalization. The first great age of

globalization (from 1815–1914) involved Britain exporting 4–5% per

annum of national income and nearly 20 million people, mainly from the

poor “Celtic Fringe” (Ireland, Scotland, and Wales) to developing

countries, above all the United States (US). Today, the US is a large

net importer of capital and people from developing countries and

reciprocal capital flows to developing countries are, to an ever

greater extent, the product of either permanent or temporary migration

of individuals seeking economic opportunities in higher income

countries, especially the US.

Carlo

Dade - 2001

Foundation Representative for Haïti and the Dominican Republic,

The Inter-American Foundation

The Development

Potential of Remittances in Latin America

Even though remittances are an old story, this is a relatively new

topic for the development community. Though, the IAF has funded

projects in, what in hindsight we now call, remittance work. The IAF

funds projects created and implemented by community organizations,

NGOs, the organized poor and other elements of civil society in Latin

America. The Foundation has neither programmatic nor sectoral

limitations. We fund the best, most innovative proposals for grassroots

development in the region. As such, we naturally receive proposals for

work with remittances. In recent years, as more and more groups in

Latin America and the Caribbean have seized upon the potential to use

remittances for grassroots development, we have received a concomitant

increase in proposals for work in this area. Yet, one of the firsts of

these projects was in…

Despite the size and scope of remittances, or perhaps because of it, we

most of the productive work with remittances occurring at the

grassroots, community to community level. This is because remittances

are tied to specific individuals and then to specific communities. It

is too large, or even conceivable, a burden to add national or regional

concerns. Or, to put it another way, a poor migrant sending home US$100

a month may occasionally be able to send an additional US$10 or US$20

to fix a church or buy a computer, but this individual likely cannot

afford to remit another US$10 or US$20 a month to fund a regional

development initiative. Where collective remittances have been used by

national governments to fund regional and national development projects

is Korea. Here the government will assess a fee, or tax, or earnings of

workers who are sent abroad by Korean companies working on projects

abroad. Another example is the fee that the Haitian government has

collected for Haitian workers recruited by Dominican companies. In both

cases government intervention amounted to imposition of a tax on labor

and or earnings. This is a crucial point for governments considering

inserting themselves into the flow of remittances.

E.

López-Córdova - 2006

Globalization, migration

and development. The role of

Mexican migrant remittances

IDB/MIF

Remittances as a Development Tool: A Regional Conference - May 2001

Remittances:Statistical

Overview 2001

Remittances – the portion of international migrant workers’ earnings

sent back to

countries of origin – have for generations been a traditional means of

financial support

to family members remaining in less-developed countries.

As the scale of migration has increased in recent years and the growth

of remittances has

accelerated dramatically, the social and economic impact of this

phenomenon now transcends

family relationships and is drawing national and international

attention.

Nowhere is this more apparent than in Latin America and the Caribbean

(LAC), where

remittances now constitute a critical flow of foreign currency to the

majority of countries. The

implications for national economies – and the corresponding potential

multiplier effect on

GDP, consumption and investment – are becoming major financial and

development issues

throughout the region.

The following statistical overview is provided as background to the

conference “Remittances

as a Development Tool: A Regional Conference,” sponsored by the

Multilateral Investment

Fund (MIF) of the Inter-American Development Bank (IDB), and the

Inter-American

Dialogue, on May 17-18, 2001, at IDB Headquarters in Washington, D.C.

This conference will

address three key themes: the economic role of remittances, reducing

the cost of transfers, and

channeling migrant capital more toward investment opportunities.

IDB/MIF

Remittances 2005.

Promoting financial democracy

Although remittances are primarily intended to meet the basic needs of

family members

back home, these funds also generate opportunities for local

communities and national

economies. Nowhere is this more apparent that in Latin America and the

Caribbean, the

fastest growing and highest volume remittance market in the world.

Currently,

remittances are sent each year from all over the world to approximately

18 million

households across the Region, mostly outside of the financial system.

E.

López-Córdova and A. Olmedo - 2006

International

remittances and development

Existing evidence, policies and recommendations

IDB/MIF

- 2006

Sending

Money Home. Leveraging the Development Impact of Remittances

The Inter-American Development Bank’s Multilateral Investment Fund

began

to intensively analyze the volume, transaction costs, and development

potential

of international remittances to Latin America and the Caribbean in

2000. At

that time, the phenomenon was literally “hidden in plain view,” the

subject of errors and

omissions columns in international financial reports.

A great deal has happened since that time. MIF programs to improve

remittance

data collection, increase competition and reduce costs in the

remittance industry, and

explore the development impact of remittances have borne fruit. Today,

we know that:

- Remittances sent to Latin America and the Caribbean from all parts of

the

world are expected to be more than $60 billion in 2006, surpassing both

the

amount of official development assistance and foreign direct investment

to the

region;

- Money transfer costs have been reduced by over 50 percent;

- Remittances constitute one of the broadest and most effective poverty

alleviation programs in the world, reaching approximately 20 million

households in the LAC region alone.

2003

Remittance senders and receivers: tracking the

transnational channels

Across the United States some six million immigrants from Latin America

now

send money to their families back home on a regular basis. The number

of senders and

the sums they dispatched grew even when the U.S. economy slowed, and

looking to the

future, the growth seems likely to continue and potentially to

accelerate. The total

remittance flow from the United States to Latin America and the

Caribbean could come

close to $30 billion this year, making it by far the largest single

remittance channel in the

world. These funds now reach large portions of the populations in the

region—18 percent

of all adults in Mexico and 28 percent in El Salvador are remittance

receivers—and the

impact is no longer limited to the countryside or to the poor. Taken

altogether these

indicators suggest that the remittance traffic in the Western

Hemisphere has crossed a

threshold not only in magnitude but also in significance.

Since the year 2000, the Multilateral Investment Fund (MIF) of the

Inter-

American Development Bank (IDB) has been addressing the issue of

remittances and

their impact on development in the Latin American and Caribbean region.

Numerous

governments, financial institutions, international development

organizations, and scholars

recognize that immigrant remittances now constitute a source of vital

income to many

developing countries and an important form of economic activity among

nations. That is

the macro picture. To better understand those developments as well as

the micro picture,

the Pew Hispanic Center (PHC) and the Multilateral Investment Fund

conducted a series

of studies in 2003 that collected information on remittance sending and

receiving from

some 11,000 individuals in the United States and Latin America. This

research includes

two separate projects: The 2003 National Survey of Latinos conducted by

the PHC and

the Kaiser Family Foundation in the United States. And, a series of

surveys and focus

groups conducted by the MIF and the PHC in Mexico, El Salvador,

Guatemala, Honduras

and Ecuador with fieldwork performed by Bendixen and Associates.

R.

Suro, S. Bendixen, B.Lindsay Lowell, and Dulce C.Benavides - 2003

Latino

Immigrants, Remittances and Banking

Billions in Motion: A Report produced in cooperation between The Pew

Hispanic Center

and The Multilateral Investment Fund

Until recently, the money management practices of Latino

immigrants in the United States aroused little attention

outside their own communities. That changed as the remittance

flow doubled in size during the second half of the

1990s. Although the size of the average remittance transfer is

miniscule—$200 to $300—in the world of international

finance, the cumulative sums have now captured the attention

of government policymakers and bankers in the United

States and Latin America. Remittances to Latin America and

the Caribbean totaled $23 billion in 2001, according to estimates

by the Multilateral Investment Fund.

Not long ago this was a cottage industry in which cash

was often hand carried across borders. In the 1990s it

evolved into a traffic dominated by wire-transfer services such

as Western Union, and now it is becoming increasingly formalized

as more credit unions offer remittance services and

with the introduction of electronic banking products that

allow a remittance deposited in an Automatic Teller Machine

(ATM) in the United States to be retrieved almost instantly

from an ATM in Latin America.

IDB -

Integration and Regional Programs Department

Integration, Trade and Hemispheric Issues Division

Institute for the Integration of Latin America and the Caribbean

(INTAL) - 2006

Integration and trade in

the Americas. Special Issue on Latin America

and Caribbean Economic

Relations with Asia-Pacific

Remittances are an increasingly important component in capital flows

between Asia and

Latin America. Japan is Asia’s key source of remittances to Latin

America, accounting

for nearly a tenth of the region’s total inflows in 2003 (table 3). In

the case of Brazil, by

far the most important recipient of Latin America-bound remittances

from Japan, this

figure is nearly 20 percent.25 While remittances to Latin America from

Japan pale next to

flows from the United States, they do exceed Latin Americans’

remittances from Europe.

Moreover, although there are fewer Latin Americans living in Japan (an

estimated

435,000, of whom 70 percent remit) than in the United States or Europe,

they tend to

send at least twice as much per transaction as Latin American migrants

in other

countries.26 According to a survey commissioned by the IDB in 2005,27

Latin American

remitters in Japan send money home some 14.5 times a year, with each

transfer averaging

$600. As a result, in absolute terms, Latin America’s remittance

revenue from Japan is

hardly trivial: in 2003, remittances from Japan totaled $3 billion,

which represents nearly

50 percent of Latin America’s exports to Japan that year. Overall, the

number of separate

annual financial transactions between Japan and Latin America that

involve remittances

are estimated at 4.5 million.

F.

Portocarrero Maisch, A. Tarazona Soria and G. D. Westley

2006

How Should Microfinance

Institutions

Best Fund Themselves?

In recent years, with the maturing of the microfinance

industry in Latin America, large numbers

of microfinance institutions (MFIs) have

greatly increased their outreach and sustainability.

Their capital structure has also been maturing

and is progressively approaching the structure

that predominates in banks.

While many MFIs initially depended on domestic

and international borrowing, their main

source of funds is now by far deposits. Thus, an

important milestone in the funding of MFIs has

been reached. This observation is based on the

analysis of a database we have constructed covering

61 MFIs that specialize in microfinance

and are subject to prudential regulation. These

61 MFIs are located in nine Latin American

countries with major microfinance markets: Bolivia,

Colombia, Ecuador, El Salvador, Honduras,

Mexico, Nicaragua, Paraguay and Peru. At

the end of 2003, the 61 MFIs had attracted US$

1.24 billion in deposits, which represented 65

percent of their total liabilities. The deposit/loan

ratio had reached 76 percent by the end of 2003,

indicating that the amount of deposits was almost

equal to the size of the loan portfolio.

Thus, it is now fair to say that deposits are no

longer the forgotten half of microfinance.

From id21 insights #60 l

January 2006

Sending money home.

Can remittances reduce poverty?

At least US$232 billion will be sent back home globally by

around 200 million migrants to their families in 2005, three

times official development aid (US$78.6 billion dollars). Moreover,

migration and remittance experts argue that the unofficial

transfers could be as large as formal flows. What impact is this

having on poverty reduction?

IDB -

2004

Sending money home:

remittance to Latin America and the Caribbean

Whatever one’s point of view, the process

and its consequences cannot be ignored –

the globalization of finance, trade, and

technology is a reality that must be

acknowledged and addressed.

However, there is one aspect of

globalization that historically has attracted

relatively little attention: the flow of

workers to fill jobs in more developed

countries, and the subsequent financial

flows back to their families in countries of

origin. But this is rapidly changing as

international organizations, national

governments, universities, foundations,

and financial institutions, are currently in

the process of “discovering remittances”.

From a purely economic perspective, this

movement of labor across borders

constitutes an international labor market

that is closely connected to the

globalization process. But, the transfer of

remittances from immigrant workers back...

From

ACCION InSight No. 10 - May 2004

Leveraging the Impact of

Remittances through Microfinance

Products: Perspectives from Market Research

ACCION’s market research on immigrants and remittances challenge the

conventional wisdom

about immigration. No longer is immigration a one-way process. A new,

transnational way of life

is emerging that immigrants create for themselves. Today, immigrants

strive to participate in two

communities at once. They pursue financial and investment goals for

themselves and their

families in the United States, while at the same time planning joint

investment projects with

families back home.

Providers of financial services are challenged to respond to this

transnational way of life with

financial products that can enhance the ability of immigrants to

participate actively in the lives

their families back home and to pursue their own goals both in the home

country and in the

United States.

IDB -

Mar del Plata - 2005

Report to the Summit of

the Americas

During the Hemispheric Summit that took place in Quebec, Canada, in

April 2001,

the Inter-American Development Bank presented a set of 22 strategic

programs

intended to contribute to meeting the mandates that stem from the

Summits of

the Americas and the commitments that are part of the Plan of Action

adopted in

Quebec.

Since then, the IDB has carried out intensive and complex financial and

technical

activities in the context of those 22 strategic programs. The programs

fall into five

areas that summarize the mandates adopted by the Heads of State and

Government of the Americas, namely: democratic governance and political

development;

integration and economic development; ecology and sustainable

development; equity and human development; and connectivity and

technological

development.

|

| |

| |

|

| |

|

| |

| |

| |

| |

| |

|

|

|